Get This Report on Mileagewise - Reconstructing Mileage Logs

Get This Report on Mileagewise - Reconstructing Mileage Logs

Blog Article

Some Known Incorrect Statements About Mileagewise - Reconstructing Mileage Logs

Table of ContentsIndicators on Mileagewise - Reconstructing Mileage Logs You Should KnowThe Single Strategy To Use For Mileagewise - Reconstructing Mileage LogsExcitement About Mileagewise - Reconstructing Mileage LogsThe Only Guide for Mileagewise - Reconstructing Mileage LogsThe 2-Minute Rule for Mileagewise - Reconstructing Mileage LogsRumored Buzz on Mileagewise - Reconstructing Mileage LogsMileagewise - Reconstructing Mileage Logs Things To Know Before You Buy

Timeero's Quickest Distance feature suggests the fastest driving route to your staff members' location. This attribute enhances productivity and adds to cost financial savings, making it a crucial property for businesses with a mobile workforce. Timeero's Suggested Route function further increases liability and efficiency. Workers can compare the recommended path with the real route taken.Such an approach to reporting and conformity simplifies the frequently complex job of taking care of mileage expenditures. There are lots of benefits related to making use of Timeero to monitor gas mileage. Allow's have a look at some of the application's most significant functions. With a trusted mileage monitoring tool, like Timeero there is no requirement to stress over mistakenly leaving out a date or piece of information on timesheets when tax time comes.

About Mileagewise - Reconstructing Mileage Logs

These added confirmation steps will maintain the IRS from having a factor to object your gas mileage documents. With accurate gas mileage tracking technology, your workers do not have to make harsh mileage price quotes or even stress regarding gas mileage expenditure monitoring.

As an example, if a staff member drove 20,000 miles and 10,000 miles are business-related, you can write off 50% of all automobile costs. You will need to proceed tracking mileage for work also if you're using the real expense technique. Maintaining gas mileage records is the only way to separate organization and individual miles and give the evidence to the internal revenue service

Many mileage trackers allow you log your journeys by hand while calculating the distance and reimbursement quantities for you. Many also featured real-time trip monitoring - you require to begin the application at the beginning of your trip and quit it when you reach your last location. These apps log your start and end addresses, and time stamps, in addition to the total distance and compensation amount.

Mileagewise - Reconstructing Mileage Logs Things To Know Before You Get This

One of the concerns that The INTERNAL REVENUE SERVICE their explanation states that lorry costs can be taken into consideration as an "average and required" price throughout working. This includes prices such as gas, upkeep, insurance, and the automobile's devaluation. Nonetheless, for these costs to be taken into consideration deductible, the automobile needs to be made use of for service functions.

9 Simple Techniques For Mileagewise - Reconstructing Mileage Logs

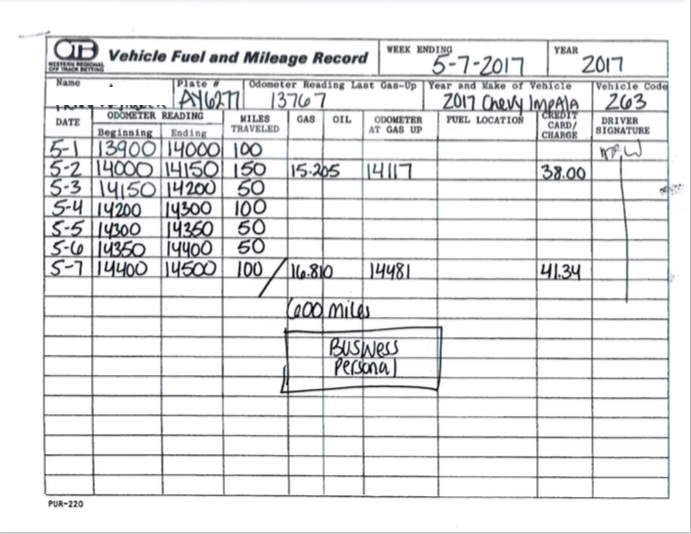

In between, faithfully track all your company journeys noting down the beginning and ending readings. For each trip, record the place and service function.

This consists of the overall service mileage and total gas mileage buildup for the year (company + personal), journey's day, destination, and purpose. It's necessary to record tasks immediately and keep a simultaneous driving log outlining day, miles driven, and organization objective. Below's exactly how you can improve record-keeping for audit functions: Begin with guaranteeing a careful mileage log for all business-related traveling.

Everything about Mileagewise - Reconstructing Mileage Logs

The real expenses method is an alternative to the basic gas mileage price approach. Instead of determining your reduction based on a fixed rate per mile, the actual expenditures method enables you to subtract the real costs linked with using your automobile for service functions - free mileage tracker. These costs include fuel, upkeep, repairs, insurance policy, depreciation, and various other relevant expenditures

Those with considerable vehicle-related costs or one-of-a-kind problems might benefit from the actual costs approach. Eventually, your picked technique ought to align with your particular economic goals and tax circumstance.

See This Report about Mileagewise - Reconstructing Mileage Logs

(https://slides.com/mi1eagewise)Determine your overall organization miles by using your start and end odometer readings, and your recorded company miles. Accurately tracking your precise gas mileage for business journeys aids in corroborating your tax obligation deduction, especially if you decide for the Criterion Gas mileage approach.

Maintaining track of your gas mileage by hand can call for diligence, however keep in mind, it might conserve you cash on your taxes. Tape-record the total mileage driven.

Our Mileagewise - Reconstructing Mileage Logs Statements

In the 1980s, the airline company market became the first industrial individuals of general practitioner. By the 2000s, the shipping market had actually adopted general practitioners to track plans. And currently nearly every person makes use of GPS to navigate. That indicates almost every person can be tracked as they deal with their organization. And there's the rub.

Report this page